A Blueprint for Attracting and Developing FinTech Talent

Mr. Uli Zeisluft, BankersLab Faculty, recently gave the keynote speech at an event hosted by Taiwan Academy of Banking and Finance (TABF). The conference was attended by 126 people representing around 35 organizations.

As we navigate the rapidly evolving landscape of financial technology, it is imperative that we not only adopt cutting-edge technologies but also nurture a corporate culture that attracts and fosters top talent.

The fintech industry has been around for a while now and is still undergoing a transformation driven by several key trends:

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are revolutionizing financial services by enhancing precision, efficiency, as well as security.

- Blockchain and Decentralized Finance (DeFi): Blockchain technology is enabling more secure and transparent transactions, while DeFi is democratizing access to financial services.

- Cloud Computing: The migration to cloud platforms is enhancing scalability, flexibility, and cost-effectiveness for fintech companies.

- Regulatory Technology (RegTech): With evolving regulatory environments, investment in RegTech is crucial for compliance and risk management.

- Environmental, Social, and Governance (ESG): ESG considerations are driving new fintech opportunities, particularly in sustainable finance.

BankersLab has worked around the world in over 40 countries, with incumbent banks, finance companies, and FinTech innovators. We have joined our clients in their innovation and talent journeys. At BankersLab, we use team-based, gamified learning to provide a safe “lab” experimental environment. Let me share some of what we’ve learned along the way:

The enormous impact of technology on our industry has changed the talent and skills that we need. But when we talk about “FinTech Talent”, what are we referring to? So, let’s take a closer look at how we can define that.

First, Define Your Organizational Goals and Journey

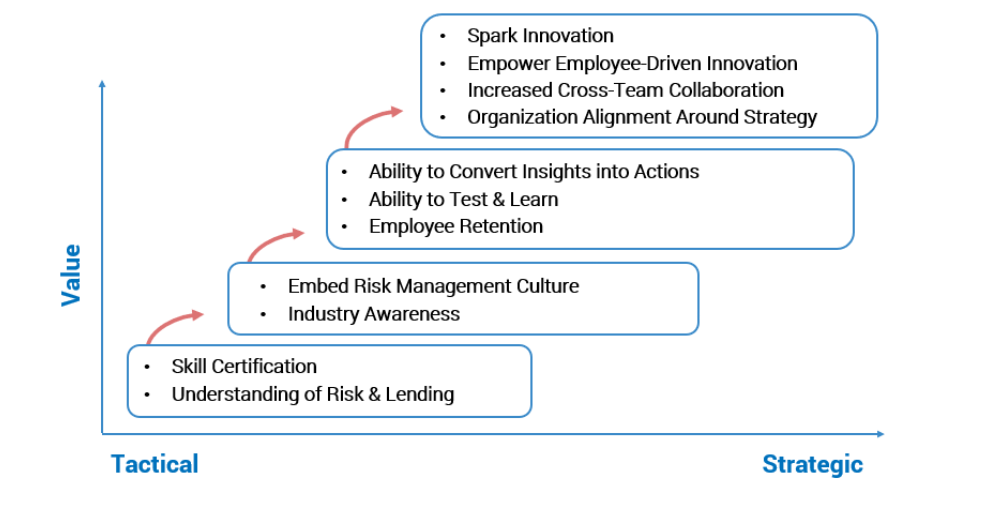

You can see that there is a wide span of goals to consider. This format provides a roadmap. First, you should ask yourself: “Where am I on this diagram, and what is my target outcome?” Then, the learning rollout can be tailored to these goals.

For some FinTech companies, they have already sparked innovation (at the top right), but they need to embed core lending skills into their engineering and technology staff who may not have been bankers in the past. For incumbent banks, they may have strong certified lending skills (at the lower left) but need to focus on sparking innovation and collaboration (at the top right).

It doesn’t really matter where on the graph you are. The crucial thing is to understand what is most important for your organization today and to move towards that goal..

One of the most critical skills we notice in our work around the globe is an employee’s ability to have a deep understanding of their subject area, coupled with the faculty to collaborate across areas. When we deliver team-based, gamified learning, we team up engineers with designers or with analysts for example. By collaborating during the learning process, they can transport that collaboration skill to their job roles. We also tend to observe the strongest team results from diverse teams, when they manage complex, virtual lending portfolios.

You need your engineers to collaborate with the compliance staff, to ensure they implement solutions which drive compliance. You need your marketing team to use data to drive their campaigns, and collaborate with your data scientists, and so forth.

We observe that the large size and ‘silos’ of the incumbent banks sometimes need to get broken down to accomplish this.

Next, Address The Needed Subject Areas

You may notice that I mention the subject areas last. If you’re selecting the right talent, who are curious, and always want to learn, you don’t need to hire them for what they know. You hire them for their ability to learn quickly and apply that knowledge. This statement may cause you to critically re-evaluate your hiring and assessment process.

Then, you can select the specific subjects required for their job role.

In the past, we often hired for subject matter expertise first. I would challenge you to re-think this approach.

Watch this space for Part 2 – Make An Impact on Your Transformation!