Are FICO Scores dead? A recent article, originally published in the Wall Street Journal explains that some big lenders are moving away from using FICO scores. Let’s take a step back and look at how credit scores are best used. Here are some things to think about:

“Reports of my death have been greatly exaggerated” – said the FICO Score

Let’s distinguish between Big Lenders and everyone else.

Situational Awareness

In the article notes, Big Lenders. First, it’s important to remember who you are and your modeling options. The FICO Score is built on the broad base of borrowers with records in the credit bureau, and highly segmented in order to more precisely measure risk for various groups. If you’re a big lender, you have a large enough base of customers that you can build an internal model on your own customers which provides richness by customer segment, while being tuned to your own portfolio. If you’re a smaller lender and begin lending to a people outside your normal borrower profile (new geography, new product, etc), your internal models will be ‘flying blind’. In these cases, FICO score to the rescue.

Market Awareness

So why do any big lenders use FICO scores if they can just build their own? Remember that FICO scores can be a factor in the interest rate charged to borrowers. The FICO score gives the lender a guess as to what your competitor might charge that borrower, which will inform your pricing decision. For some big lenders, they might use their own internal models, while referencing the FICO score to give them an indication of the “market rate” a particular customer might be charged. Further, lenders still package up mortgages for securitization based on FICO score.

Be Version-Aware

Newer versions of the FICO score put less weight on medical collection items. Further, FICO 8 ignores collection items less than $100. First, be aware of which version you are using, and any associated exception rules you might want to use. Second, if you are building an internal model, consider following some of the current best practices such as ignoring or minimizing the impact of medical collection items.

Alternative Data

There appears to be a trend towards leveraging checking account data, rental payments, utility payments and other data sources to evaluate minority and lower income borrowers. From a racial justice perspective, this might seem like a hopeful trend. However, lenders must be mindful to lend responsibility to newer borrowers to avoid their becoming over indebted. At BankersLab, we are keeping a close eye on this trend, and adding it into our simulations. We aim to help lenders strike the right balance of opening up credit to new borrowers responsibly.

Competitive Landscape for Scores

Building credit scores was commoditized years ago. Further, new data sources emerge every day, which are easily accessed via APIs — application programming interfaces which automate data exchange.

So, please nobody act surprised that there is more competition and price pressure for FICO-Score competitors. We only can hope it will increase economic opportunities for the under and newly banked, while providing meaningful insights about borrowers.

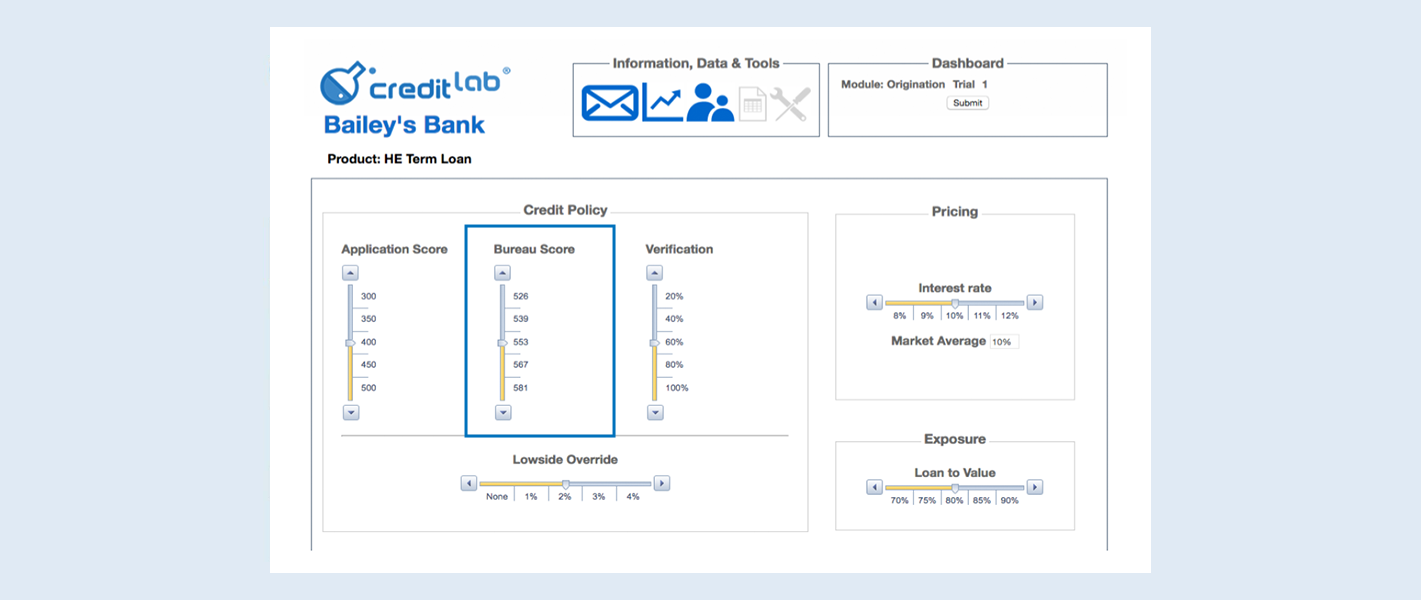

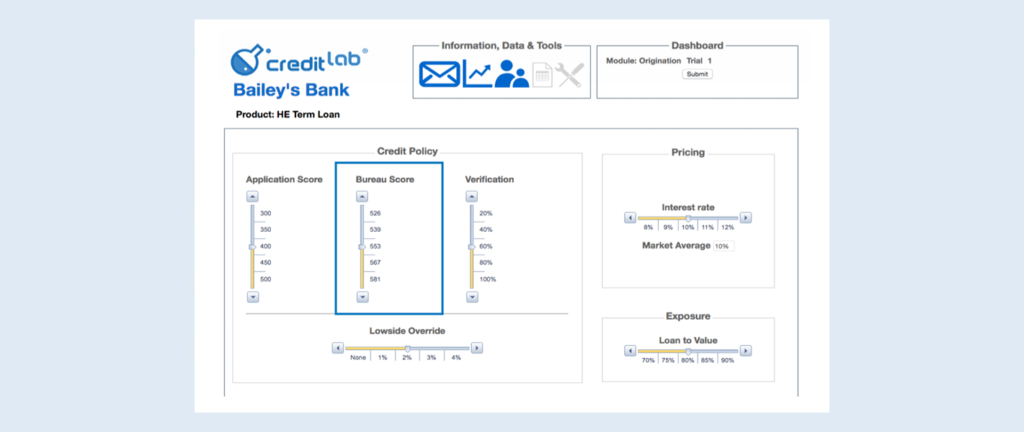

If you’d like to ‘game out’ your strategy with us in our simulation, drop us a note! in**@********ab.com