On paper, the Thai economy may look alright: GDP continues to grow, inflation is under control, and the currency is strong.

But the waters are choppy for lenders. Consumer debt and unemployment in the informal sector are high. Vehicle recovery rates are under stress; consumer delinquency is rising. The strong currency is expected to affect exports, and regulatory caps on lending interest rates compress the interest margins.

What does this mean for lenders? It’s a call to adapt and evolve in response to the changing economic landscape.

As expected, lenders have tightened their underwriting criteria. However, this dampens revenue streams, while delinquencies and defaults of previous vintages increase credit costs.

BankersLab simulated the current lending landscape in our CreditLab platform and threw down the challenge to senior and junior lending staff. Here are some of the ideas that came out of the process:

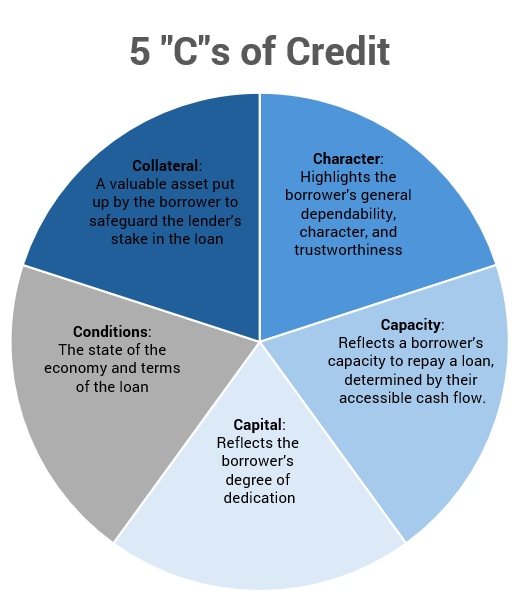

1. Don’t forget the 5th “C” of Credit: Conditions

The 5th “C” of Credit is “Conditions” – the external conditions of the economy that the borrower and lender face. This is dynamic over time and we must adjust our financial offers as things change.

In the case of Thailand, conditions are a major factor to consider. We are facing declining automobile recovery rates, regulatory caps on loan interest rates, and the possibility of declining exports.

While the borrower cannot control these factors, they should be factored into the loan offer and financials.

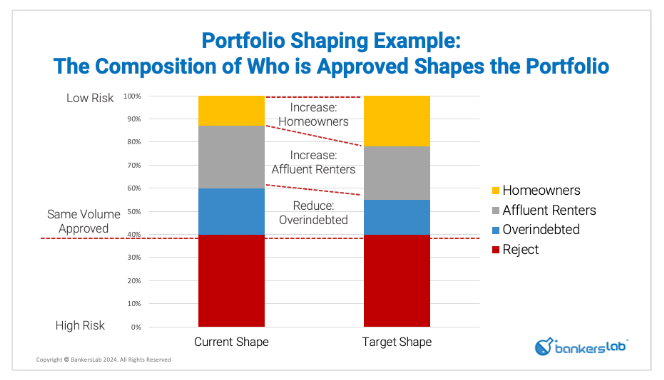

2. Shaping your application population is a risk management superpower

It’s not just about your credit policy filters. It’s about who you attract to apply for a loan. The risk teams who collaborate with the marketing teams can leverage analytics to seek out applicants who are in the more desirable risk buckets.

Luckily, Thai culture enables this. It’s not difficult to convince people to collaborate.

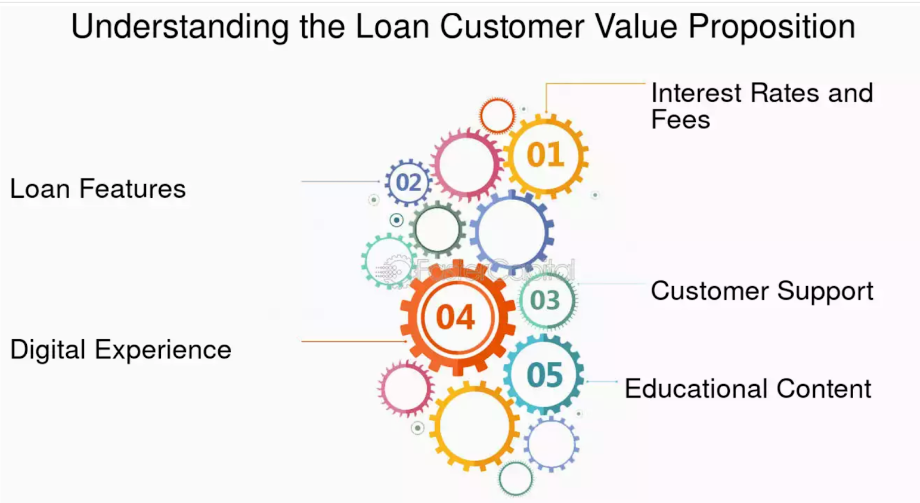

3. Continually review your product proposition

Now that you’ve found the right borrowers, ensure your product proposition appeals to them. This requires a combination of analytics, listening to your customers, and creative design. It is also a never-ending but fruitful process.

In Thailand, seeing the fountain of ideas and collaboration was heartening. Simulate, test, and learn!