The Shift to Transaction and Trended Data

Many years ago, I was asked by a large bank client to incorporate transaction data into their credit risk models. My answer was no. They asked again. Again, no. Why was I so obstinate?

The Problem

First, it would have taken months to process, tag, and aggregate the granular data. Second, how would they backtest and validate the models? Third, they would have been unable to create a live data feed at the time of loan application. How in the world did they plan to implement the models?

Since then, these obstacles have been removed. In fact, our vibrant and competitive FinTech industry has created a rich ecosystem of solutions.

“According to a 2023 LexisNexis Risk Solutions study that surveyed 225 senior U.S. financial institution decision makers for marketing, lending and credit risk, 65% of respondents use alternative credit data on anywhere from 50% up to almost 100% of all new applicants. As a result, more than half reported lending revenue increased by 15% and higher,” as reported by the Financial Brand.

So, what type of data are we talking about?

“Historically alternative data meant everything outside the three bureaus, from data from bill payments to rent, payroll, and the like, according to Stephen Greer, advisory industry consultant for Financial Services for SAS.” noted the Financial Brand. However, these days, ‘alternative data’ is…just data.

Let’s break down the terminology:

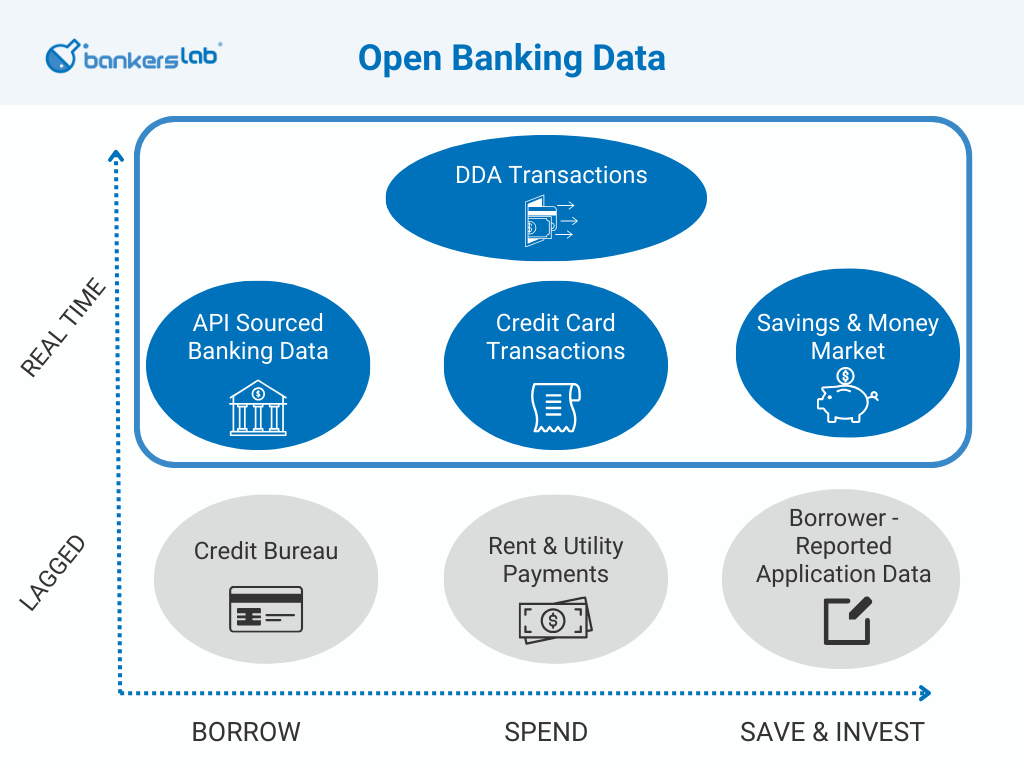

Open banking data

Financial institutions enable their end users to securely share and manage their financial data with accredited data consumers through API. By definition, this data is “real-time” since the API provides the source data as of that moment.

Aggregated data

Aggregated data is often the same type of data as open banking data (such as checking account or credit card transaction data). The open banking API data goes directly from “Bank A to Bank B”. If Bank B receives multiple sources of data via APIs, Bank B must do the aggregation themselves. In contrast, aggregated data is provided by an intermediary company who also provides preprocessing (aggregation) and value-add to that data. It is also real-time data since it is extracted via API from the various institutions real-time and aggregated.

Credit bureau data

Of course we know all about credit bureau data. One element to keep in mind is that the data is lagged. Banks report to the bureaus monthly, and the data is reported at the account, rather than transaction level. However, this data can be converted into trended data. For example, if two borrowers have a 50% credit card utilization rate today, trended data will tell us which borrower has been paying down their debit to arrive at 50%, and which borrower has been increasing their debt to arrive at 50%.

Transaction data

Transaction data refers to the information recorded from a consumer or a business’ financial transactions. Examples include:

- Credit Card Transactions

- Checking Account Transactions

Cash flow data

Cash flow data typically refers to the checking account, or DDA transaction-level data. The goal is to measure ability to repay, in real-time.

What if I were asked today to include transaction data into credit risk models?

I would respond, “Why stop there? Let’s bring in trended data, and test out some of these new data sources!” With the latest APIs and variables, the world is your oyster. Let’s test and learn!

Join us at FICO World 24 to learn more about trended data:

References:

https://www.experian.com/blogs/insights/using-trended-data-for-deeper-lending/

https://www.gdslink.com/trended-data-in-lending-benefits-challenges-and-best-practices/

https://www.fico.com/blogs/practical-applications-of-transaction-analytics